Key Takeaways

- $400 Billion AI Sales Target: Nvidia projects annual AI-related sales to approach $400 billion by 2028, reflecting significant growth from current revenues.

- Data Center Growth Drives Outlook: Increased demand for AI infrastructure in cloud computing and enterprise data centers underpins the forecast.

- Market Leadership Reinforced: Nvidia continues to lead the AI chip market, outpacing competitors such as AMD and Intel.

- Broader AI Adoption Fuels Demand: The projection is driven by expanding AI integration across sectors, including cloud services, automotive, and healthcare.

- Next Earnings Report in August: Investors will monitor Nvidia’s next quarterly results to assess progress toward this target.

Introduction

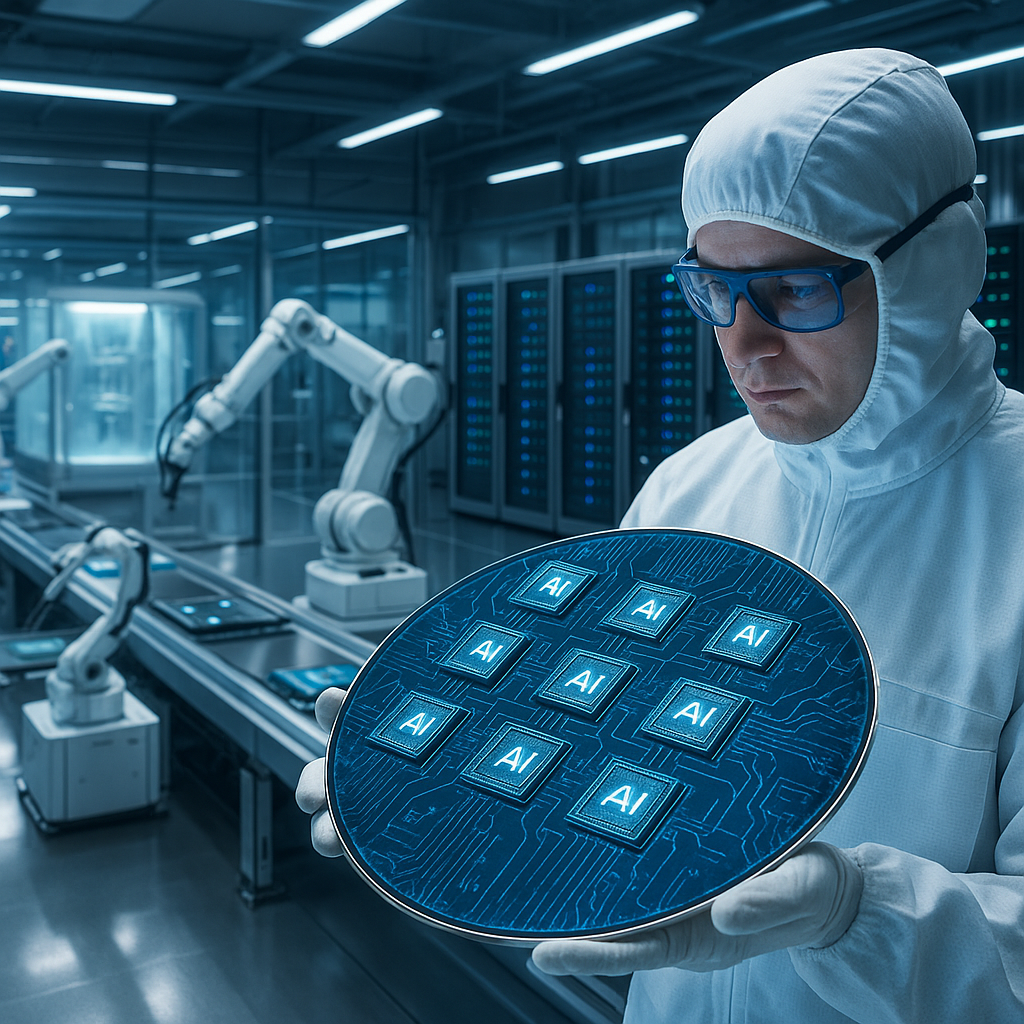

Nvidia announced on Monday that it expects annual revenue from artificial intelligence to reach nearly $400 billion by 2028. This outlook, revealed at a financial analyst event, highlights the growing demand for AI chips and data center infrastructure and reinforces Nvidia’s leadership as industries accelerate advanced AI adoption.

Growth Projections and Market Impact

During the financial analyst event, Nvidia outlined its aim for $400 billion in annual AI-related revenue by 2028. This target represents a notable increase from the company’s current revenue of $44.9 billion.

Chief Executive Jensen Huang explained that expanding enterprise adoption and increased investments in cloud infrastructure will drive the projected growth. He stated that global data centers are experiencing a major architectural transformation.

Market analysts indicated that this outlook surpasses prior Wall Street estimates. Several investment firms promptly revised their long-term expectations for the AI chip sector in response.

Un passo avanti. Sempre.

Unisciti al nostro canale Telegram per ricevere

aggiornamenti mirati, notizie selezionate e contenuti che fanno davvero la differenza.

Zero distrazioni, solo ciò che conta.

Entra nel Canale

Entra nel Canale

Core Growth Drivers

Data Center Expansion

Cloud service providers are rapidly increasing their AI infrastructure investments. Major platforms such as Microsoft Azure and Google Cloud are significantly expanding their GPU deployments.

At the event, Nvidia presented data showing that enterprise customers in finance, healthcare, and manufacturing are moving from experimental AI projects to full-scale operations.

Software and Services Integration

Nvidia highlighted that its software ecosystem, including the CUDA platform and enterprise AI solutions, will play a key role in future revenue growth.

The company estimates that software and services will account for around 20% of AI-related revenue by 2028. This marks a strategic evolution beyond a focus solely on hardware.

Industry Response

Major cloud providers voiced support for Nvidia’s growth plans. Several announced expanded partnership agreements in connection with the event.

Semiconductor competitors, including Intel and AMD, now face greater pressure to speed up their AI chip development. Both companies have released updated roadmaps in response.

Enterprise customers are adapting their infrastructure plans to leverage Nvidia’s anticipated technology advancements, particularly in areas such as large language model deployment and generative AI.

Challenges and Requirements

Nvidia acknowledged several critical factors for achieving its ambitious target. Expanding manufacturing capacity and sustained chip design innovation remain essential.

Supply chain resilience is also crucial. The company shared plans to diversify manufacturing partnerships and increase production capacity across different regions.

Maintaining a technological lead in accelerated computing and AI training will be a priority as competition intensifies.

Financial Implications

Wall Street analysts predict that this growth trajectory could have a substantial impact on Nvidia’s profit margins, which are expected to stay above industry averages.

Nvidia’s capital expenditure plans reflect its growth ambitions, with significant investments directed toward research, development, and manufacturing.

Institutional investors have started adjusting their portfolios. This has led to increased trading activity in Nvidia shares and related semiconductor stocks.

Conclusion

Nvidia’s $400 billion AI revenue forecast underscores the company’s ambitions and its effect on industry strategies, investor behavior, and competitor planning. The projection highlights ongoing changes in data center design and the broader adoption of enterprise AI.

What to watch: Further manufacturing expansions by Nvidia and developments from major cloud partners as industry adoption accelerates in the coming years.

Leave a Reply